oregon tax payment deadline

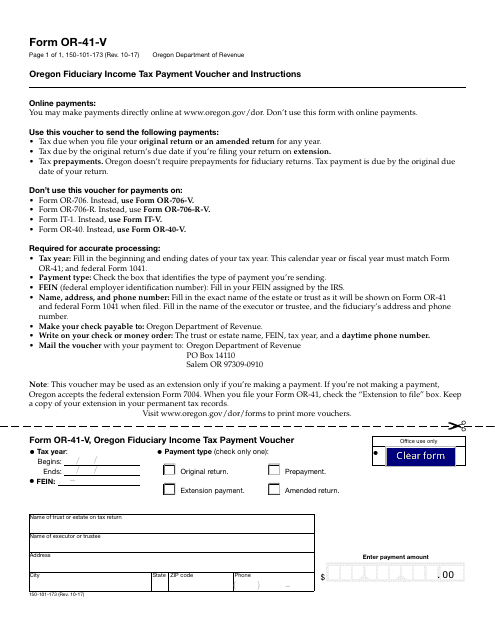

April 15 July 31 October 31 January 31. Mail a check or money order to.

Lets take a look at a few important dates.

. April 15 June 15 September 15 and December 15. If you need more time to prepare a complete and accurate return you can request an automatic six-month extension using Form 4868. If you have any questions the tax office is open during regular business hours.

Skip to the main content of the page. Vice before October 1 1991 you dont need to make Oregon estimated tax payments on your federal pension. Payment due dates Estimated tax payments are due quarterly as follows.

Fiscal year filers. What are the specific Oregon tax returns for which filing deadlines have been extended to May 17 2021. 2022 second quarter individual estimated tax payments.

April 18 2022 is the deadline to file 2021 Form 1040 and pay any tax due. The 15th day of the 4th 6th 9th and 12th months of your fiscal year. 2021 individual income tax returns filed on extension.

Cookies are required to use this site. Choose to pay directly from your bank account or by credit card. You can file your tax return by either using a local tax preparer or by using tax prep software like HR Block.

Form OR-40 OR-40-N and. Find approved tax preparation services. Annual reconciliation returns and copies of Forms W-2 are filed by January 31 following the tax year to which they relate.

Tax filing and payment due dates for individuals from April 15 2021 to May 17 2021. Oregon extended the tax deadline for filing and paying 2020 individual state income taxes to May 17. Oregon residents now have until July 15 2020 to file their state returns and pay any state tax they owe.

For 2019 state taxes the state has extended the filing and payment deadline. The Oregon tax payment deadline for payments due with the 2019 return by May 15 2020 is automatically extended to July 15 2020. Property taxes have a timeline that is different than most other taxes or bills that we pay.

As with the federal deadline extension Oregon wont charge interest or apply any penalties on unpaid balances between April 15 and July 15 2020. By phone with credit debit or prepaid card American Express not accepted. 2022 third quarter individual estimated tax payments.

Find IRS or Federal Tax Return deadline details. If paying in installments the final installment is due May 15. Withholding tax payment deadlines follow the federal employment tax deposit rules.

Free tax preparation services Learn more. Payments with returns due after May 15 2020 are not extended. 2021 Oregon Combined Payroll Tax Report Instructions for Oregon employers.

The due dates for estimated payments are. July 1 is the beginning of the new fiscal year. Any tax payment with a 2019 Oregon return due by May 15 2020 is automatically extended to July 15 2020.

503 945-8199 or 877 222-2346. Oregon Department of Revenue. If the due date falls on a Saturday Sunday or legal.

The state tax filing and payment deadline as well as deadline to pay 2021 estimated income taxes has been moved to June 15 2021 after many were impacted by winter storms in February. Victims of the Oregon wildfires and straight-line winds that began September 7 now have until January 15 2021 to file various individual. Everything you need to file and pay your Oregon taxes.

Oregon will honor the federal automatic extension to October 15 2021. Employees also must receive a copy of the Form W-2 by January 31. The Oregon Department of Revenue DOR intends to follow guidance from the IRS when more details become available.

Your browser appears to have cookies disabled. Taxes are due November 15 and may be paid in thirds. Taxes become payable in October.

Calendar year filers. Oregon Department of Revenue. Taxpayers who have filed their 2020 Oregon tax returns and owe unpaid taxes should pay the tax due by May 17 2021.

Oklahoma extended the tax deadline until June 15 2021 to pay their 2020 individual and business income taxes and their first quarter 2021 estimated income tax payments. Monday through Friday from 800 am. The Oregon tax filing and tax payment deadline is April 18 2022.

Therefore the director has issued Directors Or der 2021-01 ordering an automatic postponement of the 2020 tax year filing and payment dates for individual Oregon taxpayers to May 17 2021. Instructions for personal income and business tax tax forms payment options and tax account look up. Otherwise penalty and interest will begin to be charged after May 17 2021 for any amount remaining unpaid.

Payment of estimated tax. You dont need to do anything to get. However an extension to file is not an extension to pay.

If your federal service was both before and after October 1 1991 you may be required to make estimated tax payments based on the portion of your federal pension received for service performed after October 1 1991.

Oregon Tax Forms And Templates Pdf Download Fill And Print For Free Templateroller

Usa Oregon Pge Electricity Utility Bill Template In Word Format Bill Template Utility Bill Templates

How To File Your Taxes In Portland Oregon Cccu

Prepare Your Oregon State And Irs Income Taxes Now On Efile Com

Oregon Tax Forms And Templates Pdf Download Fill And Print For Free Templateroller

Understanding Your Property Tax Bill Clackamas County

E File Oregon Taxes For A Fast Tax Refund E File Com

Blog Oregon Restaurant Lodging Association

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

Oregon Ifta Fuel Tax Requirements

Where S My Oregon State Tax Refund Taxact Blog Tax Refund State Tax Kentucky State